Question:

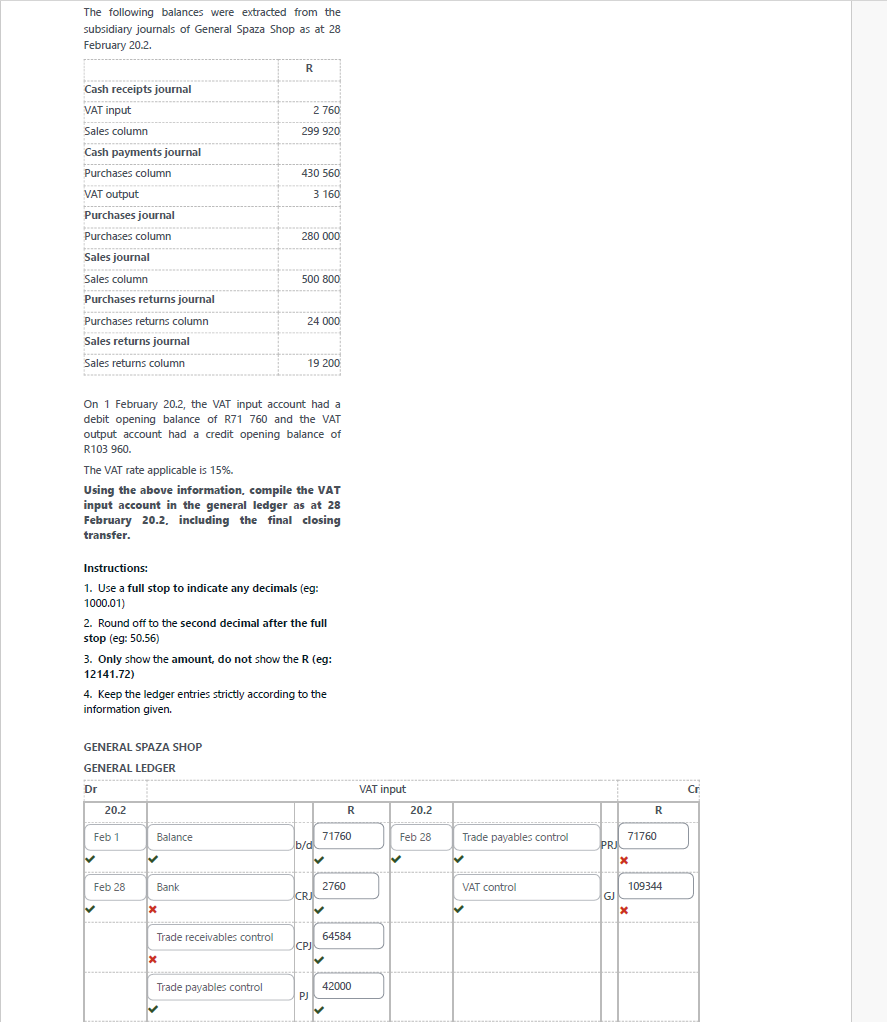

give answer in 2 steps with explanation at the end of each step and final answer at the end : The following balances were extracted from the

Subsidiary journals of General Spaza Shop as at 28

February 202.

Tw

‘Cash receipts joumal

VAT input 2760

Sales column 299920

Cash payments journal

Purchases column 0s

VAT output 3160

Purchases journal 1

Purchases column 280 000

Sales journal

Sales column 500800

‘Purchases returns journal

Purchases returns column 24000

‘Sales returns journal

Sales returns column 19.200

On 1 February 202, the VAT input account had a

debit opening balance of R71 760 and the VAT

output account had a credit opening balance of

R103 960.

‘The VAT rate applicable s 15%.

Using the above information, compile the VAT

input account in the general ledger as at 28

February 20.2. including the final closing

transfer.

Instructions:

1. Use a full stop to indicate any decimals (eg:

100001)

2. Round off to the second decimal after the full

stop (eg: 5036)

3. Only show the amount, do not show the R (eg:

1214172)

4 Keep the ledger entries strictly according to the.

information given.

‘GENERAL SPAZA SHOP.

GENERAL LEDGER

or VAT input o

202 3 202 ®

Feb1 | Balance 71760 Feb2s | Trade payables control 71760

x

Feozs | Bank 2760 VAT control of 103

x

Trade receivables control 4584

ce

Trade payabes control | | 42000

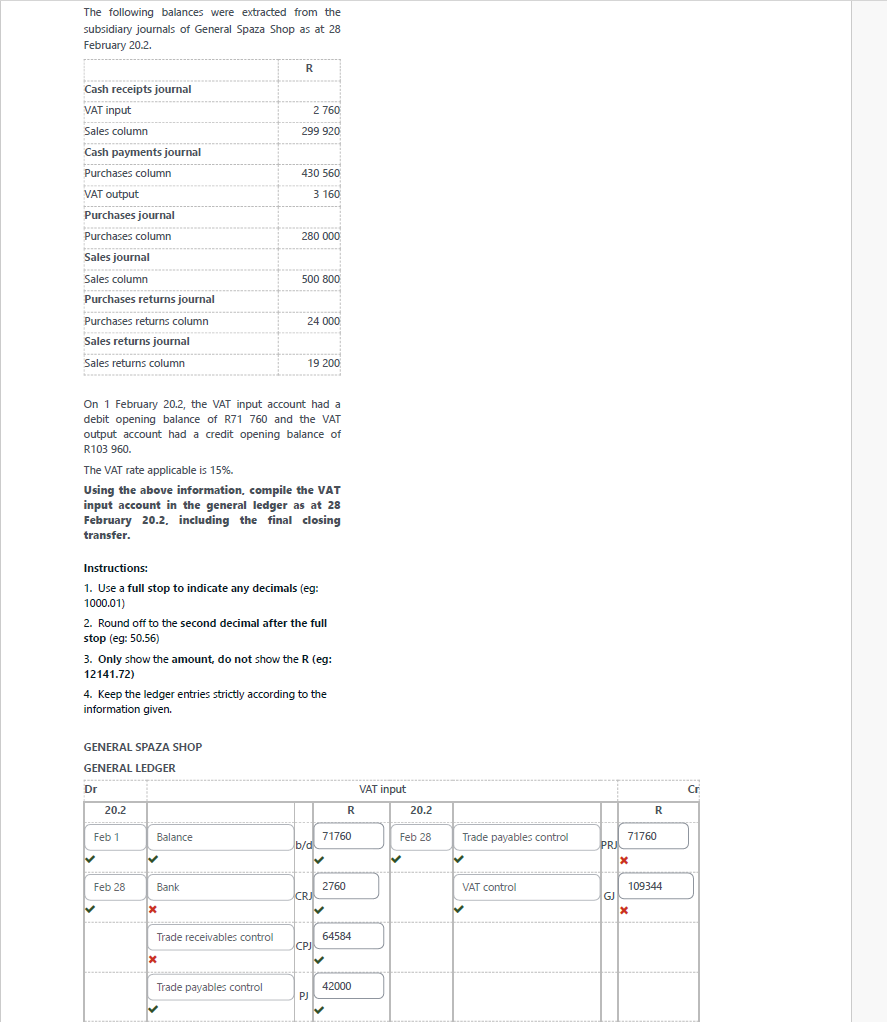

The following balances were extracted from the

Subsidiary journals of General Spaza Shop as at 28

February 202.

Tw

‘Cash receipts joumal

VAT input 2760

Sales column 299920

Cash payments journal

Purchases column 0s

VAT output 3160

Purchases journal 1

Purchases column 280 000

Sales journal

Sales column 500800

‘Purchases returns journal

Purchases returns column 24000

‘Sales returns journal

Sales returns column 19.200

On 1 February 202, the VAT input account had a

debit opening balance of R71 760 and the VAT

output account had a credit opening balance of

R103 960.

‘The VAT rate applicable s 15%.

Using the above information, compile the VAT

input account in the general ledger as at 28

February 20.2. including the final closing

transfer.

Instructions:

1. Use a full stop to indicate any decimals (eg:

100001)

2. Round off to the second decimal after the full

stop (eg: 5036)

3. Only show the amount, do not show the R (eg:

1214172)

4 Keep the ledger entries strictly according to the.

information given.

‘GENERAL SPAZA SHOP.

GENERAL LEDGER

or VAT input o

202 3 202 ®

Feb1 | Balance 71760 Feb2s | Trade payables control 71760

x

Feozs | Bank 2760 VAT control of 103

x

Trade receivables control 4584

ce

Trade payabes control | | 42000

Let's solve the problem step by step as requested:

---

### **Step 1: Summarize and Record All Entries into the VAT Input Account**

**Explanation:**

We need to gather all information relevant to the VAT input account, including the opening balance and the VAT input amounts from purchases (cash payments and purchases journals), then enter these on the **debit side** of the VAT input account.

#### **Entries on the Debit Side:**

- **Opening Balance (debit):** 71,760

- **VAT Input (cash payments journal):** 2,760

- **VAT on Purchases (cash payments column):**

\( \text{Cash payments column} = 430,560 \)

VAT = \( \frac{430,560 \times 15}{115} = 56,220.00 \)

- **VAT on Purchases (purchases journal):**

\( \text{Purchases column} = 280,000 \)

VAT = \( \frac{280,000 \times 15}{115} = 36,521.74 \)

- **VAT on Purchases Returns (purchases returns column):**

\( \text{Purchases returns column} = 24,000 \)

VAT = \( \frac{24,000 \times 15}{115} = 3,130.43 \)

*This is a return, so it will be on the credit side.*

#### **Summary of Debits:**

- Opening balance: **71,760**

- Cash payments VAT input: **2,760**

- Purchases (cash): **56,220**

- Purchases (credit): **36,521.74**

**Total Debits (before returns):**

\( 71,760 + 2,760 + 56,220 + 36,521.74 = 167,261.74 \)

---

### **Step 2: Record All Credits and Close the VAT Input Account**

**Explanation:**

Now, we record credits (including purchase returns and the closing transfer to the VAT control account), then balance the account.

#### **Entries on the Credit Side:**

- **Purchases Returns:**

\( 3,130.43 \) (from above)

- **Closing Transfer to VAT control:**

This is the balancing figure needed to close the account.

**Total Credits (excluding closing transfer):**

\( 3,130.43 \)

#### **Calculate Closing Transfer:**

- Total debits: **167,261.74**

- Less credits (returns): **3,130.43**

- **Balance to close (i.e., transfer to VAT control):**

\( 167,261.74 - 3,130.43 = 164,131.31 \)

---

## **Final Answer (VAT Input Account):**

| Date | Details | Debit (R) | Credit (R) |

|----------|---------------------------------|--------------|---------------------|

| Feb 1 | Balance b/d | 71,760.00 | |

| Feb 28 | Bank (cash payments VAT input) | 2,760.00 | |

| Feb 28 | Trade payables (purchases) | 56,220.00 | |

| Feb 28 | Trade payables (purchases) | 36,521.74 | |

| Feb 28 | Purchases returns | | 3,130.43 |

| Feb 28 | VAT control (closing transfer) | | 164,131.31 |

**Explanation:**

- All VAT input sources are debited; returns are credited.

- The closing balance is transferred to the VAT control account.

---

**Final Closing Transfer to VAT control: R164,131.31**

The following balances were extracted from the

Subsidiary journals of General Spaza Shop as at 28

February 202.

Tw

‘Cash receipts joumal

VAT input 2760

Sales column 299920

Cash payments journal

Purchases column 0s

VAT output 3160

Purchases journal 1

Purchases column 280 000

Sales journal

Sales column 500800

‘Purchases returns journal

Purchases returns column 24000

‘Sales returns journal

Sales returns column 19.200

On 1 February 202, the VAT input account had a

debit opening balance of R71 760 and the VAT

output account had a credit opening balance of

R103 960.

‘The VAT rate applicable s 15%.

Using the above information, compile the VAT

input account in the general ledger as at 28

February 20.2. including the final closing

transfer.

Instructions:

1. Use a full stop to indicate any decimals (eg:

100001)

2. Round off to the second decimal after the full

stop (eg: 5036)

3. Only show the amount, do not show the R (eg:

1214172)

4 Keep the ledger entries strictly according to the.

information given.

‘GENERAL SPAZA SHOP.

GENERAL LEDGER

or VAT input o

202 3 202 ®

Feb1 | Balance 71760 Feb2s | Trade payables control 71760

x

Feozs | Bank 2760 VAT control of 103

x

Trade receivables control 4584

ce

Trade payabes control | | 42000

The following balances were extracted from the

Subsidiary journals of General Spaza Shop as at 28

February 202.

Tw

‘Cash receipts joumal

VAT input 2760

Sales column 299920

Cash payments journal

Purchases column 0s

VAT output 3160

Purchases journal 1

Purchases column 280 000

Sales journal

Sales column 500800

‘Purchases returns journal

Purchases returns column 24000

‘Sales returns journal

Sales returns column 19.200

On 1 February 202, the VAT input account had a

debit opening balance of R71 760 and the VAT

output account had a credit opening balance of

R103 960.

‘The VAT rate applicable s 15%.

Using the above information, compile the VAT

input account in the general ledger as at 28

February 20.2. including the final closing

transfer.

Instructions:

1. Use a full stop to indicate any decimals (eg:

100001)

2. Round off to the second decimal after the full

stop (eg: 5036)

3. Only show the amount, do not show the R (eg:

1214172)

4 Keep the ledger entries strictly according to the.

information given.

‘GENERAL SPAZA SHOP.

GENERAL LEDGER

or VAT input o

202 3 202 ®

Feb1 | Balance 71760 Feb2s | Trade payables control 71760

x

Feozs | Bank 2760 VAT control of 103

x

Trade receivables control 4584

ce

Trade payabes control | | 42000